list of deductible business expenses pdf

This publication discusses common business expenses and explains what is and is not deductible. The chapters that follow cover specific expenses and list other publications and forms you may need.

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

We know youre asking yourself right now if startup costs can be considered as deductibles.

. Others may be listed separately by you. Medical Expenses That Are Deductible and Nondeductible The following are examples of eligible items for medical expense deductions. Non-Deductible Expenses Short List on Business Return 1 Expenses that were reimbursed by your employerask your tax pro whether you are obligated to claim such reimbursements for business-related expenses in whole or in partespecially items like reimbursed fines or penalties paid by you but reimbursed back to you byemployer.

Good records are essential. Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for the purposes of a trade or rental business. Business Enterprise Program DBEDVBE Labor Compliance Policy Bulletins LCPB Labor Compliance Posters.

Refer to Topic No. Remember you cant claim private expenses and make sure you keep records to support your claims. If the expense was for both work and private purposes you only claim a deduction for the work-related part.

The expenses must directly relate to earning your income. Internet Extra Work Bills iEWB Major Construction Payment and Information - Division of Accounting. Deductions for small business You can claim a deduction for most costs you incur in running your business for example staff wages marketing and business finance costs.

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses particularly those incurred to produce additional income. Others may be listed separately by. They effectively allow a taxpayer to write off the cost of.

For more information on these and other travel expenses refer to Publication 463 Travel Entertainment Gift and Car Expenses. Please note that this list is not exhaustive. Tax deductions are a form of tax incentives along with exemptions and creditsThe difference between deductions exemptions and credits is that deductions and exemptions both reduce taxable income while credits.

Business Expenses Deductible for Sole Proprietors. Claim these expenses on Form 2106 Employee Business Expenses and report them on Form 1040 or Form 1040-SR as an adjustment to income. 305 for information on recordkeeping.

Many types of business expenses are specifically addressed on the tax return with a line to enter the deductible amount. The general rules for deducting business expenses are discussed in the opening chapter. You must have a record to prove it usually a receipt.

According to the IRS those startup expenses are indeed deductible but only up to 5000 in your first year of business. Type of Medical Expenses May Include Services of recognized health care professionals Services of physicians nurses dentists opticians mental. Title VI Discrimination Complaint Form PDF Labor Compliance.

Partnering Payment Related Information.

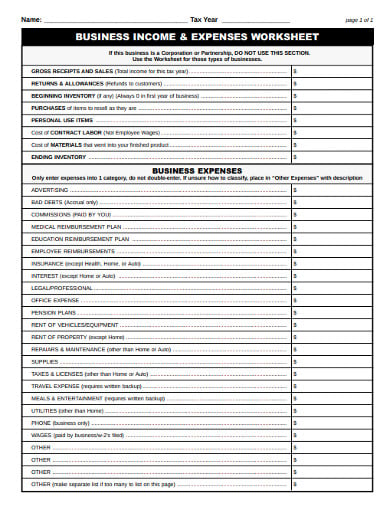

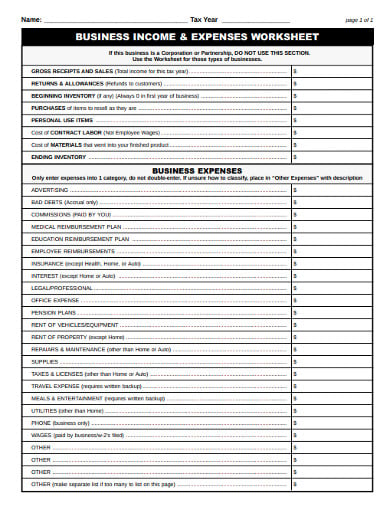

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

Deductions Worksheet Fill Out And Sign Printable Pdf Template Signnow

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Small Business Tax Business Tax Deductions Business Tax

Private Practice Tax Write Offs Free Pdf Checklist

Tax Deduction Spreadsheet Template Business Worksheet Business Budget Template Business Expense

Best Tax Deductions Fill Out And Sign Printable Pdf Template Signnow

List Of Tax Deductions Fill Online Printable Fillable Blank Pdffiller

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates